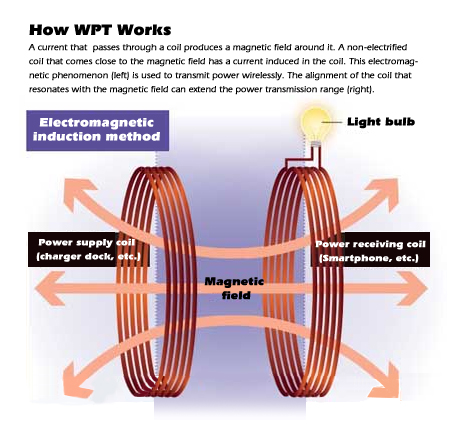

For wireless power transmission (WPT), the electromagnetic induction method makes use of a physical phenomenon discovered in the upper half of 1800s. As known widely, a current that passes through a coil produces a magnetic field around it. This electromagnetic effect was discovered by Hans Oersted, a Danish physicist in 1820. A non-electrified coil that comes close to the magnetic field has a current induced in it, which may light up a light bulb. This coil-to-coil power transmission was discovered by Michael Faraday, a British physicist in 1831, who called it “electromagnetism.”

Currently, most of the WPT-compatible smartphones and chargers in the market comply with the Qi standard developed by the Wireless Power Consortium (WPC) headquartered in the US. The Qi standard, which has its name from the Chinese “Qigong,” is led by Panasonic Corporation of Japan, Samsung Electronics Co., Ltd. of South Korea, Sony Ericsson Mobile Communications of the United Kingdom, Nokia Corporation of Finland, and Denso Corporation of Japan. The electromagnetic induction WPT standard of WPC, including the “magnetic resonance method,” the “electric wave reception method” and others, has been joined by a number of manufacturers of household appliances and automobiles in many countries. By implementing the Qi standard, any product that bears the Qi mark can be charged wirelessly, regardless of who actually manufactured it.

Technologies that compete against the Qi standard are divided into electric field coupling, magnetic resonance and line/resonator coupling.

(1) Electric field coupling, also termed “electrostatic induction,” is a kind of technology which makes two components (such as capacitors) that have a larger electrostatic capacity to exchange power by close spacing. Murata Manufacturing Co., Ltd., Takenaka Seisakusho Co., Ltd. and other Japanese manufacturers have engaged in developing this method.

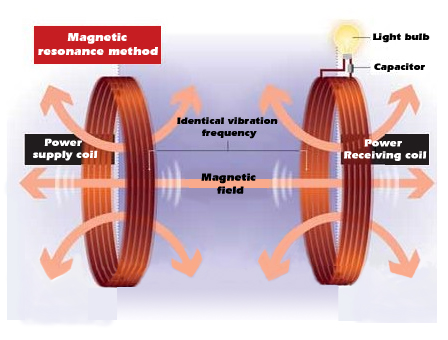

(2) Magnetic resonance is to increase the resonance between the supplying and receiving devices in electromagnetic induction.

(3) Line/resonator coupling is to exchange power by using the traveling wave path and resonator in the light communications technology and the high-frequency circuit technology. It is used to supply power to moving receiving devices whenever necessary. The Ryukoku University and other research and development (R&D) groups have engaged in developing this method.

I. Development of WPT-related standards

Currently, increasing competition is witnessed in the area of WPT-related industrial standards. The WPC developed a de facto standard since its establishment in 2008. It formulated a preliminary standard specification (the latest being V1.1) for products with an output power of 5W or less in July 2010. It now engages in developing a charging standard for medium power-consuming devices (less than 120W).

On the other side, Samsung Electronics of South Korea and Qualcomm Inc. of the United States jointly stated on May 7th, 2012 to establish a WPT-related industry group, the Alliance for Wireless Power (A4WP), with members including Samsung Electronics of South Korea, Funai Corporation of Japan, Qualcomm Inc. of the US, Broadcom Corporation of the US, SK Telecom Co., Ltd. of South Korea and NXP Semiconductors Netherlands B.V. of the Netherlands, etc. The total 35 member companies, however, are far fewer than the 137 members of the WPC. The A4WP promotes WPT technologies that provide a higher level of positioning freedom between the power supplier and the power receiver, supply power to automobiles and desktop products, and supply power to more than one product at a time. The related standard is based on magnetic resonance WPT technologies and its first version has been published internally in October 2012.

It is noteworthy, however, that Samsung Electronics of South Korea, as a formal member of the WPC, worked with Qualcomm Inc. of the US to establish the A4WP. Why it has acted in this way is worth our consideration. As far as this author can see, this parallel strategy reflects that the company wants to remain aware of how the development of the WPC is proceeding while simultaneously developing its leadership in the WPT arena.

Moreover, Funai Corporation of Japan, Haier Group of China, BURY Technologies GmbH & Co. KG of Germany, Elec & Eltek International Co. Ltd. of Singapore, Ever Win International Corporation, IDT Corporation, NXP Semiconductors Netherlands B.V., Peiker Acustic GmbH & Co. KG of Germany, Renesas Electronics Corporation, Tennrich International Corporation, Texas Instruments Inc. of the US, Triune Systems, Wurth GmbH and Underwriters Laboratories, a total of 15 companies, are members of the both alliances.

Qualcomm Inc. plans to use and promote the magnetic resonance “Wi Power” to compete against the Qi standard. “The Wi Power is technically more advantageous in which the supplier device and the receiver device can be even farther away from each other.”

Moreover, though as a member of the WPC, Samsung Electronics has engaged in developing its own technologies, such as the magnetic resonance WPT technology equipped in the charger dock for 3D goggles launched in January 2011. As early as in October 2011, it indicated, “The magnetic resonance method allows for a higher level of positioning freedom between devices, supplies more than one terminal at a time, and has a wider application scope.”

In addition, there is a global tendency to compete against the Qi standard by promoting other specifications and standards. Regarding the electromagnetic induction and magnetic resonance methods, the R6.3 subcommittee of the Consumer Electronics Association (CEA) of the US formed a working group to develop standards. And the WG4 group that develops standards for magnetic resonance is headed by technicians from Qualcomm Inc. The Telecommunications Technology Association of Korea (TTA) plans to take over the existing WPT specifications of the Consumer Electronic Association (CEA). In Germany, the Consumer Electronics for Automotive facilitates the standardization of the interface between automotive electronic control units (ECU) and portable terminals. Consumer Electronics for Automotive facilitates (CE4A, a group established by Audi, GMW, Daimler and Volkswagen in 2006, was later joined by Mercedes-Benz, Porsche, Peugeot and Citroen, and Ford. Also Participating is the Japan Automotive Software Platform and Architecture (JASPAR) through cooperation, which exchanges information with the Automotive Application Group (AAG) of the WPC.)

Exhibit 1 Electromagnetic WPT

Exhibit 2 Magnetic resonance WPT

Exhibit 3 Wireless power transmission

II. China’s progress in WPT standards

For the huge market capacity, leading such industrial signposts such as Huawei Technologies Co., Ltd., Sang Fei Consumer Communications Co., Ltd., Haier Group and Philips Corporation, China Academy of Telecommunication Research (CATR) of the Ministry of Industry and Information Technology (MIIT) as well as China Communications Standards Association (CCSA) cooperated and formulated a progression plan for WPT-related industrial standards in 2011. These standards-to-be now reach their submitting phase and combine YD/T 1312, GB 9254, GB17625, GB/T 17626, ETSIEN 301 489-1 and WPC V1.1 in a manner that is suitable for the Chinese consumer market. The following Table1 compares between different WPT standards organizations.

|

Schedule of R&D Organizations of WPT Standards | |||

|

Name |

Geographical Coverage |

Area of Interest |

Status of Standards Development |

|

GSC |

Globe |

Technical standards |

GSC-16 scheme completed |

|

IEC TC100 |

Globe |

Technical standards |

Phase-I project started |

|

ISO/IEC JTC1 |

Globe |

Technical standards |

SC6 NWI+IEC TC100 being tested |

|

CJK |

Globe |

Regulatory +

technical standards |

CCSA, ARIB and TTA in cooperation |

|

CEA |

Asia |

Technical standards |

CEA, R6.3 and WG1-WG5 in cooperation |

|

ETSI |

U.S. |

Regulatory standards |

ETSI, TC and ERM in cooperation |

|

CCSA |

Europe |

Regulatory standards |

TC9 WG1 (EMC) and WG3(RF) standards being formulated |

|

BWF/ARIB |

China |

Regulatory + technical standards |

|

|

TTA |

Japan |

Regulatory + technical standards |

PG709 draft standards passed |

III. WPT-related patent landscaping and countermeasures

Analysis of WPT-related patent applications in China

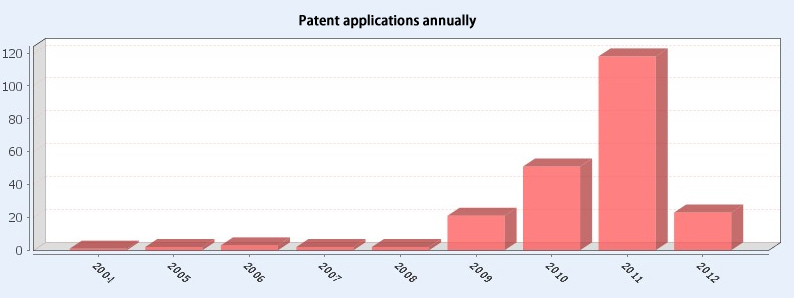

At the website of the State Intellectual Property Office (SIPO), using the keywords “Wireless Power,” the search results provide that by March 18th, 2013, the related patent applications were 434, of which 195 were under the H02J directory (power supply or distribution circuits, devices and systems; electric energy storage systems). This proves active innovation in the WPT area, and the annual tendency is as follows.

As shown, the WPT-related patent applications entered a fast developing phase since 2009.

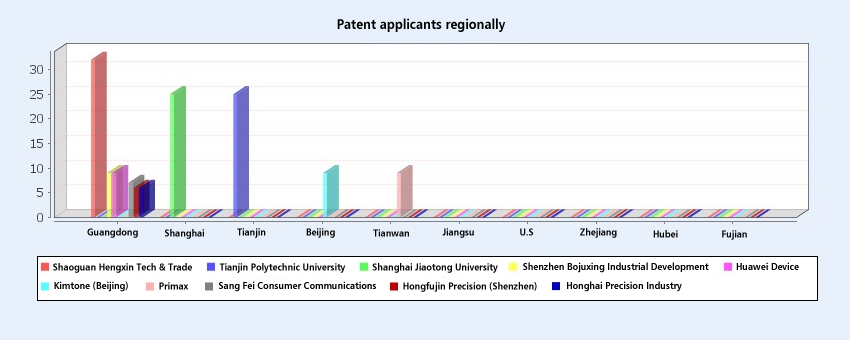

In China, the top ten applicants that file the most WPT-related patent applications are located in Guangdong, Tianjin and Shanghai, respectively in the Pearl River Delta, the Bohai Ring Area and the Yangtze River Delta. Haier Group, for example, has two of its patents published by the SIPO, including the “Wireless Power Emitting Device and Wireless Power System” filed in 2012 and the “Wireless Power Realization Device” filed in 2011, both of which have not been granted. Shanghai Jiao Tong University is also not optimistic with patent accumulation, including 2 granted patents and the other 15 invalid patent applications that must have been rejected by the SIPO. This indicates that Chinese R&D institutions and enterprises are weak in the WPT area. They should accelerate their input to avoid being charged for patent royalties in the future.

Exhibit 4 WPT-related patent application in China annually

Exhibit 5 Analysis of major applicants in China

Exhibit 6 Chinese WPT-related patent categories

Analysis of WPT-related patent applications in Japan

Among the 79 WPT-related patent applications filed in Japan, the applicant that has the highest overall strength is Panasonic Corporation, mostly attributable to the merger between Panasonic Electric Works Co., Ltd. and SANYO Electric Co., Ltd.. Panasonic Electric Works began to employ WPT technology in its electric toothbrushes and shavers since 1980s, and SANYO Electric developed its activities as one of the core members of the WPC since the latter’s establishment at the end of 2008.

The search result indicates that the WPT-related patent applications are still in their beginning stage in Japan, with the H02J directory being the No.1 hotspot technology. TDK Corporation, a company which can never be underestimated, is deploying its WPT-related patents on a large scale.

Toyota, which ranked fourth place in Japan, is also of interest. Most of its patents are on magnetic resonance WPT, while other companies are leading mostly because of their patents in electromagnetic induction WPT. Moreover, although many of its patents are filed jointly with Toyota Industries, it also has separate applications that are highly valued.

Exhibit 7 WPT-related patent ranking

(the numbers in the brackets are rankings of patent quality)

Analysis of WPT-related patents in the US

Among the 645 WPT-related patent applications in the US, most of them are under the H02J and H01F directories. Qualcomm Inc. is the No.1 in overall patent accumulation. Using “wireless energy,” “power keywords, Boolean search of the USPTO Database generates search results showing that Qualcomm Inc. has 79 published patents in the WPT area, with the earliest application date being November 2008. This indicates that Qualcomm Inc. is by far leading in the patent landscaping. The company also achieved outstanding performance results in Japan and is ranked third in overall strength in WPT-related patent applications. This helps explain why it joined hands with Samsung Electronics to create the A4WP. Second place is taken by the Massachusetts Institute of Technology (MIT), the third place by Broadcom Corporation, and the fourth place by WiTricity, a venture enterprise created by the MIT. The MIT and Broadcom Corporation have patent applications filed in Japan, but no such applications have been found from WiTricity.

A good representation of the average Qualcomm Inc., for example, has one WPT-related patent numbered US8401595 “Systems and methods for detecting and identifying a wireless power device.” This patent discloses a system and method for detecting and identifying power absorbers positioned within a charging region of a wireless power transmitter. The application date was on May 4th, 2012, and it was also filed with the European Union and the World Intellectual Property Organization. This indicates that the related technology is an essential patent, which may be incorporated into the wireless power specifications developed by the A4WP that has been joined and dominated by Qualcomm Inc.

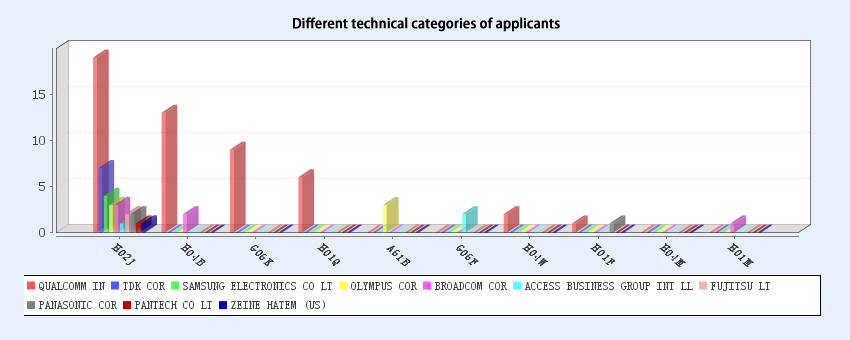

Exhibit 8 WPT-related patent applicants and technical categories in the United States

Analysis of WPT-related patents in the European Union

The European patent database contains 102 published WPT-related patents. An analysis of the data shows that larger companies, headed by Qualcomm Inc. and Samsung Electronics, have and continue to deploy a large number of patents in the WPT area. The following exhibi t shows that Qualcomm Inc. and Samsung Electronics have had significant WPT-related patents in Europe.

For example, the patent numbered KR20110091491 of Samsung Electronics, filed on September 8th, 2011, discloses a method for transmitting signals from multiple wireless power receiving apparatuses to a wireless power supplier apparatus. The patent was first filed in South Korea, and thereafter deployed in the European Union and the United States. This indicates that the patent is essential to Samsung Electronics in the WPT area. It should have our sufficient attention, as it may be incorporated into the specifications developed by the A4WP that is also dominated by Samsung Electronics.

Exhibit 9 WPT-related patent applicants and technical categories in the European Union

IV. Patent licensing policies concerning main technical standards

Patent licensing policies of the WPC

The public information shows that none of the company members of the WPC declares to charge for patent licensing. Presently, the WPC charges no fee for patent licensing for low power-consuming receivers, including mobile phones, batteries and other consumer products that receive power of 5W or less from wireless power transmitters. These patents will be free until 2014; if the base stations installed exceed 50 million in the terminal device market by the end of 2014, such patents will continue to be free thereafter. Any patent license fee will be charged by following the reasonable and non-discriminatory terms (RAND).

Patent licensing policies of the A4WP

The A4WP, which was established in May 2012, has never led and developed any published standards. The white paper shows that its members should follow the RAND terms internally; but for external licensing, it does not mandate any rules, but allows its members to decide according to their own rules.

V. Conclusion

To sum up, the WPT area has been growing fast, and in the past three years, Qualcomm Inc. of the US, Samsung Electronics of South Korea, Panasonic Corporation of Japan, the Tianjin Polytechnic University and Shanghai Jiao Tong University of China have engaged in deploying their related patents. Globally, the WPC and the A4WP also engage to develop their standards. But, there is no organization that declares any judgment rules concerning what constitutes essential or core patents in the WPT area. Chinese enterprises and research institutions should lose no time in deploying their essential patents in WPT-related apparatuses, conversion efficiency and transmitting and receiving systems for consumer electronics and automobiles, in order to obtain a say in related patented technologies in the future.

(Translated by Ren Qingtao)

|

Copyright © 2003-2018 China Intellectual Property Magazine,All rights Reserved . www.chinaipmagazine.com 京ICP备09051062号 |

|

|