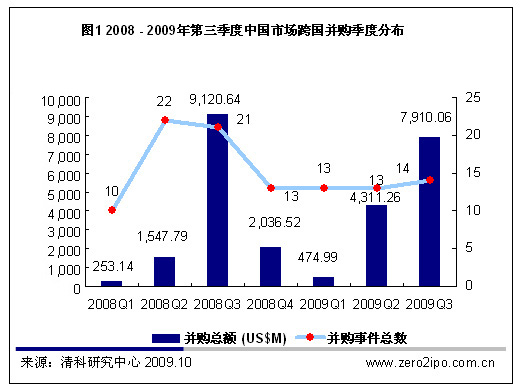

As the year of 2009 wrapped up, a resurgence of overseas mergers and acquisitions (M&A) by domestic enterprises reached a climax. Throughout the entire year, Chinese enterprises rode out the impact waves of the financial crisis and kept on heating up campaigns to “buy the dips” abroad. 2009 witnessed a record as the amount of overseas investment and M&A reached an estimated USD 30-35 billion, three times that of 2008, and the momentum is expected to peak in 2010. An official with the Ministry of Commerce also said that the ministry would continue to encourage and support Chinese enterprises in their “going global” strategies.

In 2009, there were the much-hyped acquisition of Volvo from Ford by Geely Holding Group, the acquisition of a Chilean iron ore mine by Shunde Rixin Development Company, and the high profile acquisition of Sweden’s Saab by Beijing Automotive Industry Holding Co. That year, Chinese enterprises in the limelight were mostly related to the overseas “dip buying,” and the amount of M&A was further refreshed at the end of the year. Therefore, the year of 2009 was dubbed the “China Year of M&A” by the industry.

Chinese enterprises “buying the dips” abroad

■ On December 23, 2009, Beijing Auto held a news conference in Beijing regarding its acquisition of intellectual property from Saab Automobile AB and its strategy to develop its own-branded vehicles. Beijing Auto agreed to pay USD 200 million to acquire vehicle platforms for the current generation Saab 9-5 and two generations of Saab 9-3, technology rights of two sets of turbocharged engines, and transmissions, and some tooling for manufacturing.

■ On March 27, 2009, Geely announced its acquisition of Australian automatic transmission supplier Drivetrain Systems International (DSI), also the world’s second largest, at a price of not more than 58 million Australian dollars.

■ On December 6, 2009, Yanzhou Coal Mining Company Limited paid 19 billion Yuan to acquire a 100% stake claim in Australian coal producer Felix Resources, the largest M&A deal by a domestic enterprise in Australia. After completion of the acquisition, Yanzhou Coal would obtain an approved coal reserve of 1.5 billion tons in Australia and its annual coal output in Australia was expected to exceed 10 million tons.

■ On December 3, 2009, Xi’an Aircraft Industry (Group) Company Limited and Hong Kong private equity firm Advanced Treasure Limited (ATL) jointly invested USD58 million to acquire 91.25% stake in Austrian aerospace supplier Future Advanced Composite Components (FACC), the first time a European aerospace manufacturing company was acquired by an Asian aerospace manufacturing company.

■ On August 28, 2009, Baosteel Group invested about 1.804 billion Yuan in cash to take a 15% stake in Australia’s Aquila Resources, making Baosteel the second-largest shareholder of Aquila. It was also Baosteel’s first successful overseas investment in a listed company.

■ On May 25, 2009, PetroChina Company Limited acquired 45.51% stake in Singapore Petroleum Company Limited and 49% stake of an Osaka refinery in Japan; won the right through bidding to develop the Halfaya oil field in Iraq; and acquired the common shares of JSC “Mangistaumunaigas” (MMG) in Kazakhstan.

■ On July 6, 2009, Zhejiang EverFlourish Electrical Co., Ltd. acquired its former employer Germany’s FGS, putting on a new placard of “EverFlourish Europe GmbH.”

■ In April 2009, Ningbo Sunrise Electronics Co., Ltd. acquired the entire share capital of Mahk Co., Ltd. which had over 40 years of experience in manufacturing lenses.

■ In April 2009, Soundking Group Co., Ltd. successfully purchased the world famous manufacturer of sound mixing desks Cadac Electronics. In June, Shanshan Group acquired Australian Westend Estate Wines Co., Ltd……

“Going out” is just the beginning

In 2002, Chinese enterprises invested only USD 200 million abroad through M&A and the amount jumped to USD 834 million in 2003, showing a trend of rapid increase. In 2004, Lenovo’s purchase of IBM personal business amounted to USD 1.75 billion alone. Although the amount of annual M&A tended to increase each year, but this year has witnessed a quick succession of “palm movements.”

The important factor that leading to the overseas M&A by Chinese enterprises is the diminution of the value of the enterprises incurred by the financial crisis, which quickens the pace of Chinese enterprises to “go out” and provides them with very rare opportunities. At the same time, it also brings out possibilities of making mistakes. Perhaps, for Chinese enterprises, each opportunity is a step away for them to become a “pioneer” or a “martyr” as Chinese enterprises explore “going global” strategies.

According to a survey, in the first two months of this year, there were 22 M&A deals by Chinese enterprises, involving an amount of up to USD 21.8 billion; up 40% year on year, the second highest in the world.

With China’s rapid economic development, either State-owned enterprises or private enterprises are certain to take the road of going out into the international arena. For Chinese enterprises, going out is not only aimed at expanding the enterprise scale, but in obtaining advanced technology and management, research, develop and exploit deeper integration of resources, enhance independent R&D and innovation capabilities, and expedite the process of the entry of their own brands into the international market. The above are also the prioritized missions of Chinese enterprises.

What’s next?

For Chinese enterprises, “going out” is only the first step in the Long March. Industry experts admitted that many enterprises were being “lured” out by investment bankers. When our journalist sought advice from various lawyers in connection with overseas M&A by Chinese enterprises, they also indicated that some enterprises may have not considered intellectual property issues after the M&A. Are Chinese enterprises aware of the ensuing practical issues and do they have the strengths to handle them?

Statistics show that more than half of the international M&A deals eventually fail. Numerous investigations reveal that many M&A deals failed to achieve their expected objectives; in other words, the chances of M&A failures are high. Previous M&A practices by Chinese enterprises have also fully demonstrated this point.

Entry into the developed economies by Chinese enterprises is essentially different from that of mature multinationals into the emerging economies. Chinese enterprises often enter developed markets only by way of the acquisition of stock assets, but these assets only bring short-lived flowers and applause to the Chinese enterprises; therefore, the various problems and risks to follow cannot be ignored.

At the end of 2009, Mercer Management Consulting published the results of a survey which showed that the integration of organizational culture and the integration of human resources are the two most serious problems encountered after M&A deals, accounting for 50% and 35% respectively. Meanwhile, keeping leaders and managers has also become an important factor, affecting the success of an M&A deal, accounting for up to 16%.

In addition, overseas M&A by Chinese enterprises have given unprecedented priority to the acquisition of intellectual property rights in 2009. In so doing, many enterprises hoped to speed up the development of their own brands and thus quicken the pace of entering the international markets. At the same time many problems have also followed, such as how to manage patents, how to maintain independence of the brands, how to fully demonstrate the core values of intellectual property, and how to integrate the acquired brands with the existing products after M&A deals.

Jiang Zhipei, former Chief Justice of the IPR Tribunal of the Supreme People’s Court, said that Chinese enterprises should learn intellectual property management systems from multinationals and strengthens control over intellectual property related rights after an acquisition in order to achieve the real objectives of the acquisition and integration. They should also pay attention to the importance of intermediate services during M&A, and “money must be spent where necessary.”

(Translated by Wang Hongjun)

|

Copyright © 2003-2018 China Intellectual Property Magazine,All rights Reserved . www.chinaipmagazine.com 京ICP备09051062号 |

|

|