The contract manufacturer in Honduras, Vietnam or Croatia analyzes IP constantly; as does the customer in Bogota, Tokyo or London. In our experience we have observed IP being analyzed and valued all over the world.

For example, the consumer who elects to spend $1 extra for a branded item vs. a non-branded item has “valued” the brand IP; and the consumer who selects the cheaper unbranded item has also “valued” the IP. The manufacturer who elects to produce a copycat version of an IP-protected product has also valued the IP, and has valued the likelihood and cost of being penalized for infringement. IP analysis and valuation occurs all the time, all over the world. However, only a fraction of IP analysis and valuation is delivered in the form of a professional analyst’s report. Every potential transaction, every opportunity pursued, and every opportunity not pursued, inherently involves an IP valuation analysis.

The Global Technology Impact Forum (GTIF), created by WIPO (the World Intellectual Property Organization) and LESI (The Licensing Executive’s Society International), held their inaugural event in Geneva Switzerland this past January 2012. The stated goal of GTIF, as written on the front page of its brochure was:

“To coordinate and communicate the efforts of leading organizations seeking to further IP licensing and the transfer of technology in order to spur economic growth and societal benefit”

A key topic area for the GTIF revolved around simplified global IP valuation standards. The focus was narrowed down to the following four main points:

1. What valuation methods are currently being used globally – in 60+ countries?

2. What standards can be implemented in local or regional markets without hindering market growth?

3. Should standard accounting and public reporting requirements be developed for IP-based transactions?

4. Can a central database of technology available for license or acquisition be created, including government-owned technology? Would such a database be useful?

Focus on Knowledge Transfer Rather than Standards

Valuation standards are plentiful, but most focus on the delivery of a valuation analysis, rather than how to value IP, or which methods to use when valuing IP. By our count, there are already approximately 30 groups issuing valuation credentials and/or standards. There is no need for GTIF, LESI, WIPO, or another group to issue their own set of IP valuation standards and methodologies.

Our review of current valuation and analysis standards finds that those existing standards all share the common goal of encouraging thoroughness and complexity in valuation for analysis reports. Standards intend the reporting of an IP analysis to contain common sense ingredients, such as: why the valuation is being performed, the date of the valuation, who engaged the analyst, the context of the valuation assignment, discussion of all methods considered and used, etc. Standards do not indicate which methods should or should not be used, and do not provide any additional knowledge facilitating a better analysis of IP.

The marginal impact of GTIF, LESI, WIPO or any other body adding to the number of groups and associations already issuing standards is low. One more set of standards will have little impact in advancing the performance of IP analysis globally—unless a simple valuation methodology that is useful in LDCs (less developed countries) can be developed. The question is: What is the best way to value locally developed IP to reflect local market conditions in LDCs?

Based on our experience working with IP owners and IP users globally, we’ve developed a few suggestions and recommendations for GTIF’s efforts going forward—as well as a simplified valuation methodology that would be useful in LDCs: the “Local Market Affordability Method” (LMAM), which we discuss below.

WIPO’s “Intellectual Property Valuation Primer for Policymakers and Technology Officers” is a step in the right direction, providing a focus on knowledge transfer over standards. However, IP analysis, like many other professional services, is continually evolving. The IP analysis profession must continuously improve and simplify the methodologies and approaches used to analyze the value of IP assets in all global markets.

GTIF and its associated groups should continue to work to create forums for the sharing and review of IP analysis practices; offer opportunities for practiced professionals to share peer review innovative analysis, and licensing and monetization techniques; offer the opportunity for professionals practicing in technology IP to share techniques with professionals practicing in trademarks, copyrights and marketing IP, and vice versa; and offer opportunities for less-seasoned professionals to obtain knowledge from their peers.

Standards sit on shelves, knowledge advances our profession.

Recognize the Differences in IP Analysis and Value in Different Markets; A Simplified Valuation Model

Valuation is art and science, containing both qualitative and quantitative elements. Two professionals can, and often do, apply the same methodologies to the same asset at the same time in different markets--and conclude different results. This is not necessarily a problem. The purpose of valuation is to guide a transaction, relying on the best available information at the time of the analysis--in a specific market.

No organization or group will change the fact that IP analysis occurs all the time. But would a potential infringer elect not to infringe if they possessed sounder valuation analysis skills and tools? We think so. Would there be more IP transactions if IP analysis skills were understood and practiced on a wider scale? Yes. The GTIF can promote advancement in the analysis of IP, so that IP transactions are executed from positions of greater understanding.

GTIF can and should teach and disseminate knowledge and know-how. The knowledge disseminated should include tools, techniques and tips for informal and formal analyses of IP. To the developing world IP owner, IP user and IP consumer, simple analytical techniques can be as powerful as complex techniques.

As the practice of IP analysis improves, the number of IP transactions will increase in LDCs. With more tools, more manufacturers, more consumers, and more IP owners will seek more innovative means to use and monetize IP.

Complementary Analytical Techniques Suited to Informal Analysis / Best valuation methods for LDC markets?

In developed countries, we know that many valuations are geared towards litigation matters or public offerings. LDCs are not as concerned with those issues. IP valuations should use analytical tools that are

1. Straightforward to use;

2. Mirror complex methods used in markets where data resources do exist; and

3. Able to be implemented using data available to the parties considering an IP transaction.

In developed markets, valuation analysts use combinations of the income, cost, and market based approaches. However, the means of applying these approaches are not always relevant in new/emerging markets; partly because required inputs and data either do not exist, or are not coherently collectible.

To circumvent the problem of data availability, we recommend a simple analytical tool based on the income approach that requires assumptions about local market conditions. The Local Market Affordability Method (LMAM) is based on comparing straight-forward assumptions for local revenue generated from using the IP, the cost to produce locally, and an estimate of the cost to obtain the IP. A measure of value can be determined by using such factors such as: how many units can be sold within a local transportation zone; how many units can be produced; and by factoring the cost of locally made materials. Estimates are developed primarily based on the largest local metro market perspective, based on research that any prospective IP user can develop by “walking around” and surveying the landscape of his or her local market.

By requiring only assumptions that are locally measurable, the LMAM analysis works on a local level, in all developing countries, and essentially asserts that the value of the IP is equal to profits achieved by the business using the IP, less any investments required to obtain or use the IP. The LMAM is a modified income approach, focused on the IP user’s particular geographical region and market.

While it is understood that intangibles directly impact product price, quality, productivity, waste, and overall sustainability of the product and the organization – and therefore costs, revenues, customer service, satisfaction, and market value - these factors are more integrated with the general success and the day-to-day reality of running a business in an LDC.

More widespread use of informal analytical techniques leads to more IP transactions, and greater thirst for proficiency in the use of analytical techniques. Before our community of IP analysts creates another forum to implement standards in LDCs, we offer the simple LMAM approach to analyzing and valuing IP, which is applicable and immediately useable. We hope the LMAM sparks development of additional tools that can be disseminated throughout IP users in LDCs.

A Brief Description of the LMAM

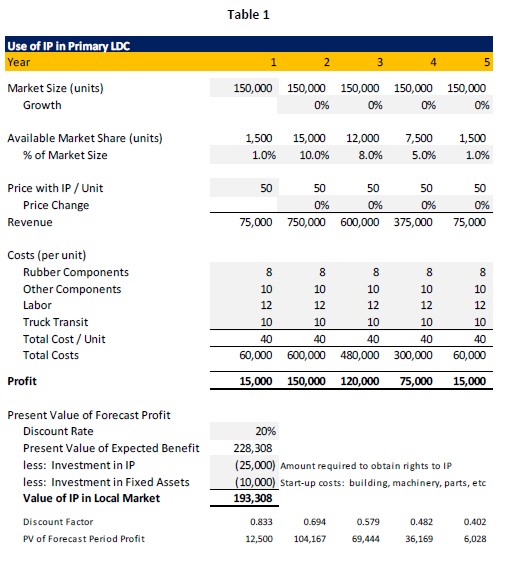

At Table 1, we provide a sample of the LMAM, applied to the primary market for which any IP is intended to be used.

CONSOR believes that this simple, local market-based analytical tool is especially well suited to LDCs. It is basic, based on accepted valuation methodologies, easily adjustable, and accurately reflects local market conditions. Furthermore, it is a method of valuation that can be understood by the average person doing business in any LDC, as well as sophisticated IP owners and users. This tool allows the focus to be placed on key assumptions for business success rather than complicated searches for data.

In Table 1, the areas shaded in grey indicate assumptions required to conduct the analysis. Each assumption can be developed by local market participants, and each assumption can be tailored to reflect local market conditions.

Briefly, the assumptions are:

The LMAM is essentially an income approach with seven assumptions. These assumptions can be developed through study of the local market. Applying a basic discount rate enables the IP user to focus on the price and cost inputs, thereby focusing on assumptions and inputs related to their area of business. By focusing on analytical inputs that can be obtained from the local market, the analysis of IP will spread.

This basic tool could be used to compare different price or cost scenarios. It can be used to compare opportunities in more than one local market, even more than one LDC. The assumptions should focus on the profits achieved from bringing IP-based products to different markets. The advantage of a simple tool is that is can be used successfully in many different ways.

Conclusion

The purpose of valuation analysis is to provide a reasonable indication of value for a potential transaction. The LMAM model is a starting point for IP users and owners in LDCs. With straight-forward tools, knowledge should improve. As knowledge and communication improve, so too will the amount and quality of IP-based transactions.

GTIF, and all IP groups involved in this conference, can best achieve their goal of “seeking to further IP licensing and the transfer of technology” by serving as a forum for knowledge, creation, and transfer. Rather than publishing more standards, GTIF, WIPO and LESI might focus on accomplishing the following:

1. Complement their IP Valuation Primer with forums to promote knowledge transfer in the field of IP Analysis;

2. Promote innovation, at both the simple and complex analytical level;

3. Promote alternative analytical techniques to be used when complex analysis is impractical; and

4. Promote some form of the LMAM valuation approach discussed here to be applied in LDCs.

|

Copyright © 2003-2018 China Intellectual Property Magazine,All rights Reserved . www.chinaipmagazine.com 京ICP备09051062号 |

|

|